I haven’t done one of these in awhile, because the Earth still won’t stop spinning too quickly for me to do all the things I want to do in a day. But there was too much good stuff I wanted to include with my latest RGJ column that I just didn’t have the space for.

The biggest is really this – just as lower taxes do not necessarily equal lower spending (or less government), higher taxes do not also necessarily mean more spending (or bigger government). You can lower rates and see an increase in revenue due to increased economic activity (such as the deficit reducing and economy stimulating Bush Tax Cuts). Or you can raise tax rates and see revenue actually shrink. Or, sometimes you raise revenue for some very necessary public infrastructure improvement (better schools or roads which woo businesses to settle in your town) and see long term growth.

A couple of pieces I’ve recently come across help shed light on what the 2015 Legislative session and the tax increases passed by those folks actually did in terms of growing government.

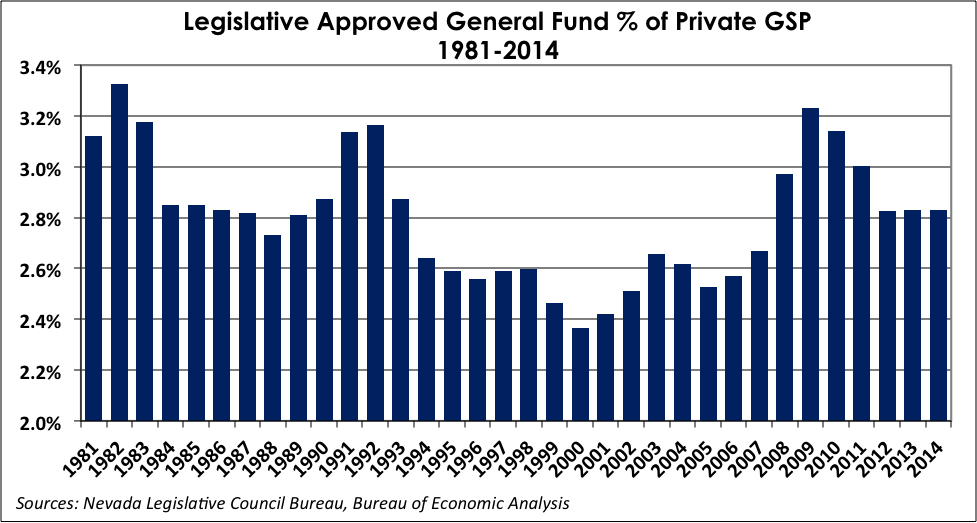

The first is an analysis from RCG Economics, which looked at General Fund expenditures as a percentage of private sector Gross State Product. It makes sense to look at it in these terms instead of by sheer dollars – as an example, Texas has a bigger government in terms of raw budget and number of people employed than does Rhode Island, but that doesn’t mean the government of Texas is “bigger” in terms of money wasted, red tape, or overall life intrusion.

If you like cool graphs like this one, go to RCG’s website immediately. There’s a ton of fascinating stuff there, even to a guy who had to retake two math classes in college.

As can be seen, Nevada’s government hasn’t really gotten significantly bigger under Governor Sandoval – in fact, so far, it’s actually shrunk a bit. It’ll be interesting to see how these numbers spin out over the next two years, and to see if Tesla payouts, school choice, Taxi Cartel death blows, and Washoe County wineries will make those numbers better or worse.

The second is a piece by my friend (and my Assemblyman) Randy Kirner in the RGJ, which came out the same time as mine. Randy gets a lot of ridiculous flack from “conservatives” who don’t understand their own economic philosophies for trying to solve long term problems (PERS in particular) and the pathetic state of our education system, while keeping government as small as possible (but not smaller). He’s one of the smartest guys I’ve met in the legislature. He, too, likes to look at, you know, numbers, and to look at them in their proper context.

On a per capita basis adjusted for inflation, the legislatively approved general fund appropriations:

•In FY1992, was $662.0 per person.

•In FY2005, it was $665.6 per person.

•In FY2006, it was $674.7 per person.

•In FY2007, it was $692.0 per person.

•In FY2008, it was $715.4 per person.

•In FY 2009, it was $771.2 per person.

•Since 2009 the so-called Sunset Taxes were implemented to keep the state afloat; at the same time we reduced government spending, tightened our belts like most families in Nevada, and in FY2013 for example, it was just $607.2 per person… in budget terms, an astronomical reduction from FY2009.

•Even with new taxes and/or revised taxes, the budget is just $646.8/person in FY2016 and in FY2017 is $655.6/person. That includes the governor’s new education initiatives. Lower than 1992 and, even now, lower than much of this past decade. It is time we acknowledge our state has grown and so too the needs.

Not every tax increase is also a size-and-scope-of-government increase, and under Sandoval, per capita government in Nevada has gotten smaller, not larger.

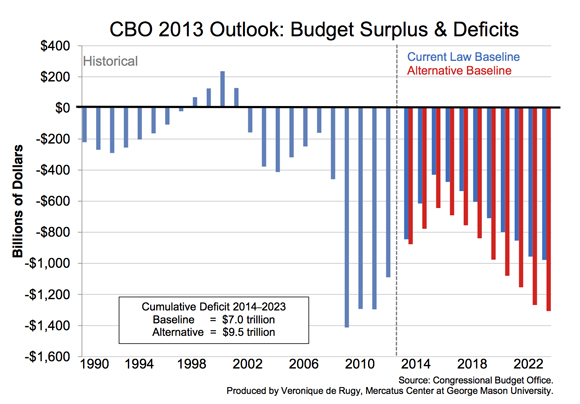

This doesn’t mean we should run out and raise taxes. It doesn’t mean we shouldn’t look for ways to cut them. It definitely doesn’t mean we shouldn’t look at how we tax things – not all taxes have the same economic impact. It doesn’t mean that we should embrace liberal economic thought and spend our way into un-pay-back-able debt.

But it does mean that we should look at taxes beyond the two dimensions so many people trying to discuss economics get stuck in. (“Less taxes = GOOD!” – as if there’s no level too low. “More taxes = GOOD!” as if government can do no wrong with your money, and as if taking it from wealth creators has no negative impact.)

None of this is the whole story, of course, and no government economic policy can predict or take into account every factor which might substantially impact the economy (which is a good reason not to pretend that governments can “run” economies).

ORRIN JOHNSON Spending and Taxes – Bonus Features: I haven’t done one of these in awhile, because the Earth st… http://t.co/GjfIxnsZr5